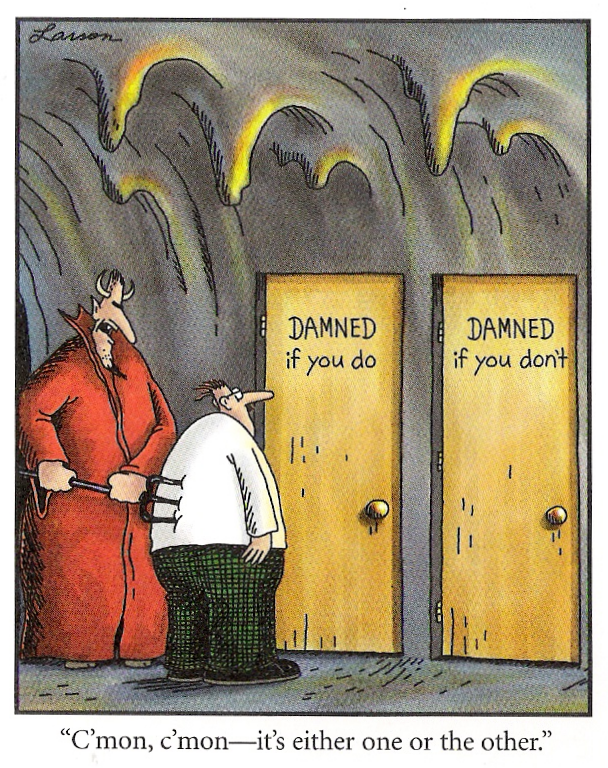

C'mon, c'mon--it's either one or the other.

(Self-involved, maudlin, and possibly illogical. You were warned, O hypothetical reader.)

Ben Bernanke, the chairman of the federal reserve is standing up before congress this morning, preparing to receive, I imagine, the economic advice he's coached them to give. Tuesday night NPR's Marketplace painted a story of looming economic stagflation: the twin perils of low economic growth coupled with inflation. The economics witches would have the esteemed chairman sail closer to the beast than the maelstrom, maybe lose a few hands, but not the whole ship. Rate cuts by the Fed would help avert a recession they say, but those same cuts would also enhance inflationary dangers. The Fed, and Marketplace too, seems to think that a recession is worse than inflation. Is it?

As an aside, I suppose the interpretation makes sense. A rate cut will encourage more borrowing to absorb more goods-n-services (and it's not like that's ever bit us in the ass or anything), and the generation of that bank debt as well as the usual money creation from the reserves will cause the inflation. [Yes, I'm being coy with the word "usual." Money creation, I'm reading, is a little more nuanced than I realized--I'd actually thought that the Fed was jiggering with the velocity of money in these rate cuts, but evidently not so much. I always imagine this stuff would be easier if they presented a straightforward mathematical frame. It's no so unworldly to have variables depend on one another, but so much of what I read is like a debate between tastes great and less filling.]

In any case, I'm going to proceed as if Marketplace's analysis is basically correct, and we're facing an ultimatum between interest rates and growth. The consequence of low growth is, as I understand it, fewer jobs, stagnant wages, and decreased demand for stuff. The consequence of inflation is higher prices.

Daniel Gross pooh-poohs decreased demand as a bonus, even when if it holds a hope that housing prices may finally adjust back to income levels, or that any rational person might rejoice at seeing the managerial class (Gross's hope is more and better MBAs) finally getting an overdue swift kick, or that market forces should dare push us to consume something more commensurate with what we produce.

The extent to which I agree with Dan, Ben, and NPR has a lot to do with what I want to believe about wages. Real wages have been stagnant for ten years now, even while profits and overall GDP for that matter have been doing just fine. To the extent that compensation increases to cover inflation, it doesn't work me up too much how the currency is valued. In that same decade, however, home prices have doubled, and energy prices have tripled. Health care costs have bumped up at least 50%. For the last three or four years, my cost of living increases have not covered this enhanced cost of living. I have an okay mortgage, but can't move to the nice neighborhoods the repairmen and nurses fifteen years older than me live in, and it's harder than ever to climb out of the hole of student and other debt. To divert the concept of stagnant wages, some conservative economic analysts like to add benefits (retirement and health care) to it, that is, treat employee costs as wages, but Krugman's closer to my anecdotal experience to be sure: wages flat, and if it costs more for my employers to keep me around, then that's another critical problem, not a feature.

A situation of low growth and low inflation sounds better than the opposite case, provided I keep my job. It's no fun standing still, but growth does me dick-all if I don't get paid more. Borrowing for growth bets that, when the debt is paid off, the growth will have outstripped the funny money, and unless I increase my personal debt against bubbled assets--home equity and a 401k is all I've got, both of which cost money to borrow against--then the way that growth has been working isn't helping me much. When the economy is based on lending, it seems to be a good deal for the lenders. [IOZ nailed this one (again).] But still, until we immigrate or breed ourselves into even less availabe space, my house is still only worth so much "real" value, and there sure as hell won't be oil forever.

No comments:

Post a Comment