The Next Bubble?

[There was cleanup called on Aisle Keifus. This post is still among my most boring, not to mention borderline ignorant, but the more egregious writing errors have been corrected. It's not like this blog is going to hit the big-time, and sometimes I just have to get stuff out.]

Complicated life choices are an unavoidable consequence of living in interesting times. How can I guide the kids toward a positive life experience that doesn't charge the price of defiance (or doesn't insist on charging it), but can still minimize their indenture to the Way Things Are.* How to offer them options for success or happiness that aren't limited to the treadmill, or the rat race? Convince each of them to invest in a hundred fifty thousand dollars worth of college, with no savings to speak of, an unsure direction (as it should be at this point, before they're even in highschool), and no solid expectation of future employment? My feelings about the value of learning, the value of keeping our citizens educated, and my memories of the experience--let's face it, my elitism--are running straight at the wall of rapidly escalating costs. I prefer my kids to go if it fits into their still-hard-to-judge life plan, even if The Man callously demands it from them anyway. I just have no idea how I'm going to pay for it.

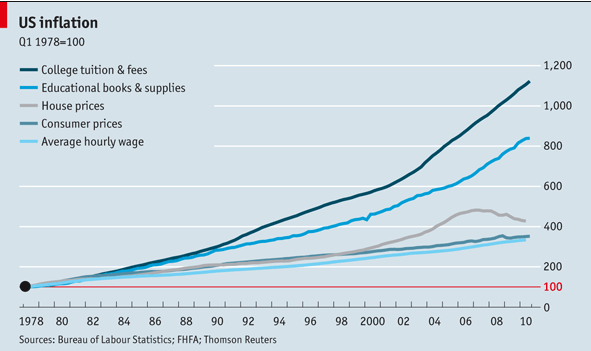

Here is a graph of college costs posted recently at the Naked Capitalism blog.

Since the early 1980s (at least), they have been rising a great deal faster than inflation, faster even than our monstrously inflated home values did. Given what happened there, Yves Smith points out in that post her fears of a bubble. Student debt (as oppposed to mere costs) has jumped up 25%, and meanwhile, a job upon exit is harder to come by than ever. Currently, unemployment rates among 20- to 24-year-olds is up around 15%, and even with the 2005 "improvements" on bankruptcy laws, defaults on student loans are also rising. Meanwhile the lifetime net income gain of a college education is estimated at a couple hundred thousand dollars, which might leave my kids just enough dough to put my grandkids through, assuming no one in this chain plans on ever retiring, or getting sick.

At some point in our lives, we all get the "savings" spiel, how compounded growth is magical and how great it is to get in early. But exponential growth applies to negative rates too, making it so much harder to get out of the hole (especially if you get in early), and differences in those rates tends to open up chasms when they're perpetuated over years. Here is a helpful aricle by the College Board talking about rising student costs. They estimate that the growth rates in college prices from 1977 to 2007 (approximately the same range as in Yves' graph), has been about 4.5% for public schools, 3% for private ones (which remain much more expensive), and about 1.5% for public 2-year colleges ("community colleges") per year over inflation. Factoring in room and board makes the four-year schools (students are assumed to commute to two-year ones) look a little better, knocking about a percentage point off of each of those values. This tells us that tuition alone is bloating faster than the cost of dormitories or apartment rentals, but that the net effect has still been growing faster than everything else has for 35 years.

What about all that sweet, sweet financial aid? I'm glad that the College Board reports this too, and net costs show similar trends. They also break 'em down relative to household income, and here's a result that I didn't expect: according to their data, "upper middle class" folks such as me have seen no change in the percentage of their income they devote to their kids' college costs between 1992 (when my college was getting financed) and 2003 ("now" for the purposes of conversation). Although, I can still salvage a little self-pity. Here in New England, both college costs and incomes are higher than in other parts of the country, so I can look forward to increased net payout, and also life in a lower income group than the national averages suggest.

On the other hand, and as usual, it's far worse for lower income people, who are not only getting pushed into college much more than they used to, but have a bigger burden than they once did. It's not just that a matter of costs growing equally for everyone. The increase on the lower end of costs relative to income is reflective of the fact that these families have become poorer since 1992. The growth rate of income has been much different for the different qunitiles (Why the census likes to bin things up in quintiles, while the college board prefers quartiles is left as an exercise to the reader. Downloadable tabulated data could have given you a better post, but would have wasted more of my time.). Lower income people didn't benefit from a growing economy at all, while rich folks did so disproportionality, and the speed of that separation has accelerated, a grand canyon of inequality. Middle class people (at least outside of New England) have been just barely keeping up with the growing expense of those important things that are not in the CPI, which is perhaps why we don't have a revolution yet.

But anyway, the data tells me, to my surprise, that it shouldn't be any harder for me to put my kids through school than it was for my parents (who pretty much killed themselves to do it), even while great other segments of the population are getting right fucked. Even there, there are a few key omissions in that analysis:

So even for the middle class, that nominally static fraction of our income still looks a lot like a growing debt trap, as the other demands on that income have increased, and as the cycle of debt closes to meet across the generations. As mentioned above, student loan debt has shot up 25% since the early nineties, which is far beyond what costs did. Mom and Dad have less to contribute, and so Junior takes on a bigger chunk himself. More people need to go to college to provide the credentialism that employers increasingly demand, (and to soak up the lack of quality jobs they offer) and meanwhile the economy is recessing, and unemployment is high.

If it's a bubble, then how does it collapse? When you default on your mortgage, at least they can take your house. The justification for your college loan is your future income. What's in the deal for lenders when you can't cough it up? Are we looking at peonage? Debtor's prisons? (It's a trick question of course. Student loans are guaranteed by the government. They'll take your taxes and slowly rescind your benefits.)

I'll accept that loan availability gradually drives up tuition prices. People can generate more money to go, and so they get charged more for the same thing. Where does it all go? Universities don't pay professors a hell of a lot more than they used to, especially given the purported value of their extensive education, and there are fewer tenure positions available, and more temporary ones, not to mention a glut of eager degreed people to fill them all. Administration as a buck-sucker is a good hypothesis, but even CEO-scale pay increases at the top don't really seem enough to be enough to soak up all those additional dollars. Not only are tuitions skyrocketing, attendance is going up too. In public universities, decreasing state funds is blamed, and that is no doubt part of the story, but it still doesn't account for the way that private education has similarly ballooned. It probably does explain the difference in the rates of cost growth vs. private school, but they're both still growing.

Another usual story is that it goes to ridiculous infrastructure improvements: spiffy buildings, meticulous landscaping, sports teams, palatial dorms, sparkling research facilities. Speaking anecdotally, every residential universtiy I've been within a mile of has been sick with this improvement disease, and it probably explains why commuter schools are growing less fast (but dorms alone don't seem to cut it as a cause, looking at the mroe modest growth of room and board compared to tuition that the College Board reports). The story is that all of this is done to attract students, but that doesn't compute, considering there are more students than ever, coughing up more bucks. Even if they didn't raise the margin, colleges should be be raking it in based on volume. I have mixed feelings about these big collegiate infrastructure investments. I am sentimental about tradition, preserving the older feel of these places, and hate to see unnecessary changes, at absurd cost. But as for the attention, these institutions may be reinforcing the last connections with learning and culture our society can expect, and that strikes me as worth preservational effort. And the improvements don't need to be constant: if the money spigot does start to lose flow, they can always stop building all this shit, just let the basketball team go pro already.

I've been intrigued (and not at all surprised) by statements, usually in blog comments, that the loan availability is also largely influenced by loan providers. More money lent means more business, and maybe sharking accounts for the baseline super-inflationary growth that we see in community colleges (which, as opposed to the residential four-years, don't spend anything on superstar professors, computer systems, and media castles). From the investment end, a couple percent growth per year seems like a pretty stable vehicle, and it's foolish to imagine they're treated as anything else, and naive to think that how this fact may benefit the borrower is a chief concern. [Editors note: Keifus was taken behind the woodpile and is now aware that baseline 1.5% growth is the increase in alleged value of an education, not of an existing investment. An already-written-up loan package only grows by its own interest rate structures, although it's perceived stability, the presence of side bets, and suckers to sell it to, no doubt help to increase what you can sell the next loan for, just like in the mortgage world. Does the increase in new loan values correlate with an actual 1.5% increase in value of an education? That's kind of the danger.] Are student loans securitized and ranked like mortgages have been? Yes, although asset-backed securities like this are reputed to be more stable and conservative than housing stock. I don't have the faintest idea whether these loan packages are as shakily insured and inappropriately leveraged as the mortgage obligations were--that'd take a real researcher to uncover. (It looks like they managed to remove caps on adjustable rates somewhere around 2000, although I might not be understanding that

* We're by no means there yet. My opinion is that it's worth it to learn what's good about life before you're forced to accept its inadequacies, which will happen soon enough.

No comments:

Post a Comment